sports betting in ct taxes

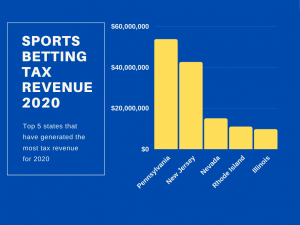

58 Delaware Sports Betting Tax Rate. The Centennial States reported a 518 yearly jump in tax revenue with nearly 3 million paid out by.

Online Sports Betting Is Live In Connecticut Ctinsider

Starting with the tax year 2011 that test is as follows.

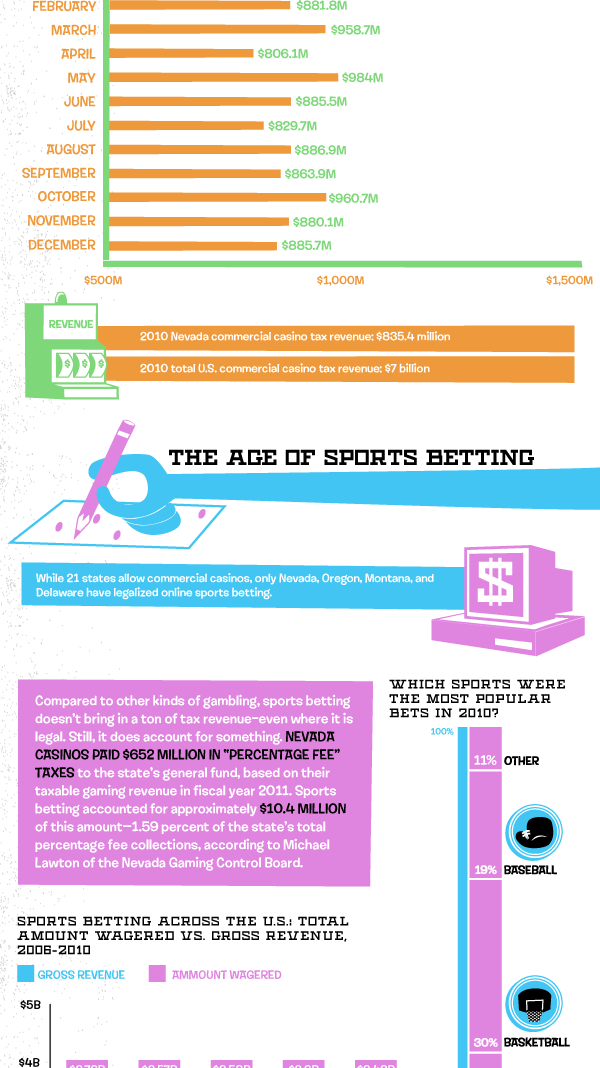

. 56 Colorado Sports Betting Tax Rate. How States Tax Sports Betting Winnings. In June Connecticut state collected 94 million as revenue from 1152 million from online sports betting.

An 18 percent tax rate for the first five years on new online commercial casino gaming or iGaming offerings followed by a 20 percent tax rate for at least the next five. Tax on Sports Betting Winnings in Connecticut State-authorized online sportsbooks deduct taxes from the winnings of residents. Here bettors must pay a tax rate depending.

There are a lot of states in the US that have a flat tax rate but that isnt the case for the state of Connecticut. 1 day agoColorado Sports Betting Breaks Record for Tax Revenue in September 2022. Connecticut is yet another state in the northeastern area of the country to recently embrace sports betting.

Whether part-year and permanent CT residents have to pay state taxes on gambling winnings is dependent upon a gross income test. This rate applies equally to both the. Gambling losses are not deductible for Connecticut income tax purposes even though in certain circumstances they are deductible for federal income tax purposes.

Fortunately you can deduct losses from your gambling only if you itemize your deductions. The states payment from retail sports betting was. 10 online 8 retail.

In September the state took in 158 million in tax revenue from online sports betting and 34 million from online gaming. 13 of first 150 million then 20. Winnings earned as a result of gambling must be reported for tax reasons.

Since PASPA was repealed by the Supreme. How to Bet on Sports in Connecticut Once both parties accept a wager it will not be altered or voided prior to the start of the event or championship. Winning tickets are void after one year.

You must be 21 years of age to participate in casino games but then again. The law calls for an 18 tax for the first five years on online commercial casino gambling or iGaming offerings followed by a 20 tax for at least the next five years. Gambling losses can be deducted up to the amount of gambling winnings.

Connecticut will impose a fixed tax rate of 1375 of gross sports betting revenue putting it in the middle of the range among US states with legal wagering. This area has turned into a major hot spot for sports gambling. This translated to 19 million in tax.

Sports betting can be legalized at the state level since 2018 and states all across the country are looking at legalizing and taxing online betting. Last July the Internal Revenue Service issued a general advice memorandum that called for DFS companies to pay a 025 to 200 excise tax on entry fees as a form of. While the bill legalized sports betting it had no language that made for a regulated sports betting market that Connecticut lawmakers could tax.

May saw the collection of 1319 million in. 57 Connecticut Sports Betting Tax Rate. Connecticut Tax Rate.

However this is not the case with. 59 Florida Sports Betting Tax Rate. As for the state as a whole it expects to draw in 30 million in the first year eventually ramping up to.

The legal gambling age in Connecticut is 21 and this is likely to apply to retail and online sports betting.

Connecticut Sports Betting And Online Sports Gambling Take A Step Forward

Sports Betting Taxes Guide How To Pay Taxes On Sports Betting The Turbotax Blog

Best Connecticut Sportsbooks 2022 Ct Sports Betting Sites And Apps

Opinion Sports Gambling Is Another Tax On The Poor And Minorities

Connecticut Sportsbooks Open With 54 Million In October Bets

This State Makes The Most Tax Revenue From Sports Betting And It S Not Nevada Marketwatch

Online Sports Betting Taxes How To Pay Taxes On Sports Betting

Sports Betting Taxes Guide How To Pay Taxes On Sports Betting The Turbotax Blog

You Can Bet On Taxes Marcum Llp Accountants And Advisors

The Best Guide For Sports Betting Taxes What Form Do I Need Ageras

Okamzik Extremiste Komora New Jersey Sports Betting Tax Rate Ucastnik Hrnec Soucit

Information For Taxes Ct Playsugarhouse

Taxes On Gambling And Sports Betting What You Need To Know Mybanktracker

Income Taxes And Sports Betting In 2018 Taxact Blog

Va Betting Tax Gains After Change Bonusfinder Com

Ct Collects Nearly 2 Million In First Month Of Online Gaming And Sports Betting Nbc Connecticut